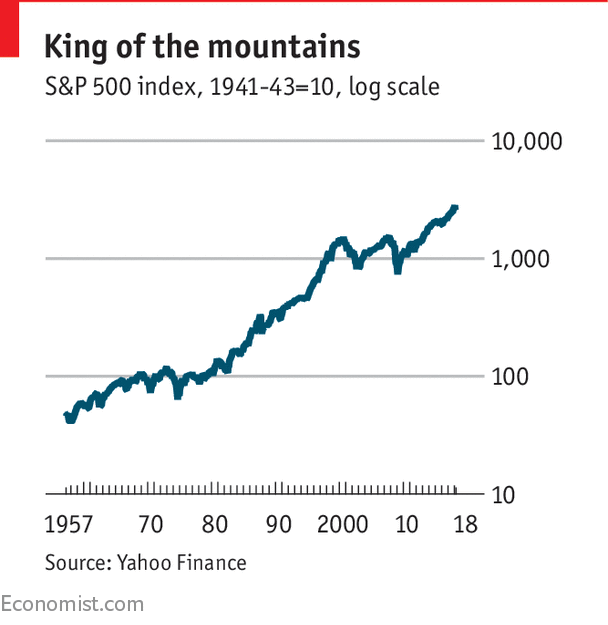

THERE is an old children's game called Kerplunk. It is similar in concept to Jenga. Marbles are poured into a plastic tube through which sticks have been threaded. The players take it in turns to remove the sticks with the aim of avoiding the fall of marbles. The normal pattern is for a few marbles to drop until the unlucky player removes the strut that keeps up the rest. A noisy crash ensues.

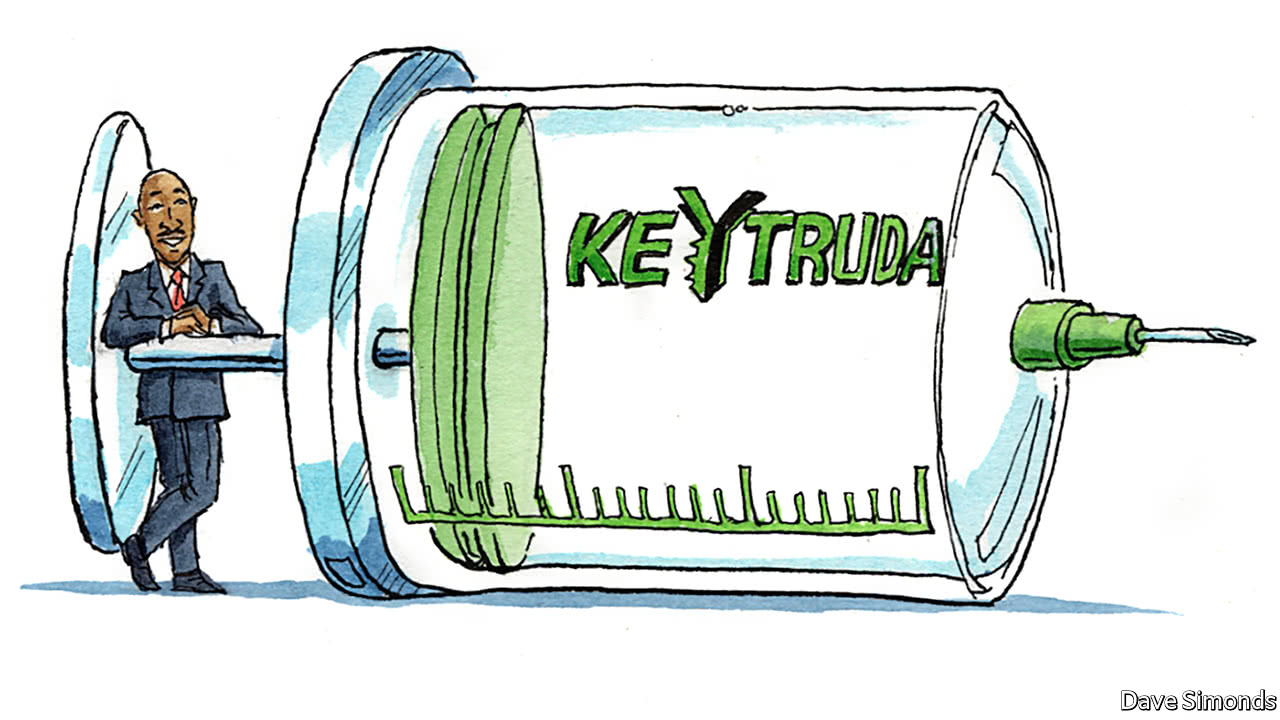

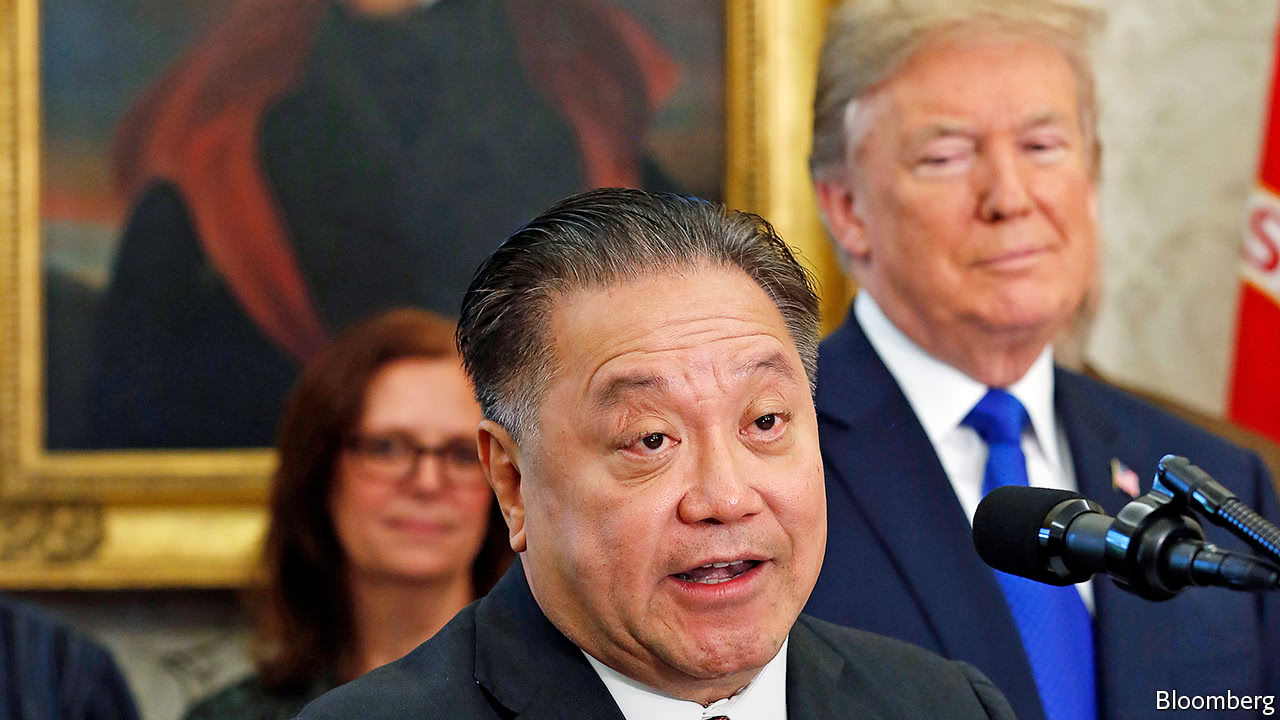

Jerome Powell (pictured), the new chairman of the Federal Reserve, may be that unlucky player. Janet Yellen, his respected predecessor, managed to pull out five sticks (ie, raised rates five times) before she departed, leaving both the economy and the markets in fine shape. Doubtless, Ms Yellen was not happy when President Donald Trump denied her a second term. But it may have been a blessing in disguise. The task of the central banker gets a lot more difficult from here.

Mr Powell's first Congressional testimony as Fed chair yesterday was seen as bullish on the economy...Continue reading

from Business and finance https://www.economist.com/blogs/buttonwood/2018/02/fed-and-markets?fsrc=rss

https://www.economist.com/sites/default/files/20180303_BLP507.jpg